Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Small businesses must deal with a number of challenges. As daily obstacles come up, it may be difficult to focus on long-term planning. However, planning, especially when it comes to finances, is critical to your business’s success.

One thing small business owners should consider from the beginning is creating a separate bank account for their business.

A number of small business owners, especially less experienced ones, do not keep their business finances separate from their personal finances.

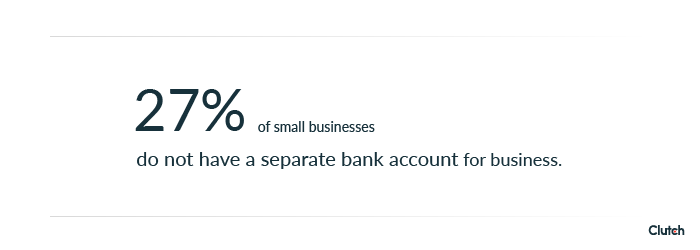

A recent survey by B2B research firm Clutch found that 27% of small business owners or managers do not have a separate bank account for their business.

Nearly 80% of small business owners with 5 years or more of experience keep separate bank accounts. This is compared to 68% of small business owners with 1-2 years or less of experience.

This is a choice with potentially dangerous consequences. Why should businesses have separate bank accounts? And how can a business go about separating its finances?

Table of Contents

In the midst of your day-to-day business activities, it’s easy to lose track of transactions. Was that specific purchase something that could be written off as a business expense? Do you know for sure?

Keeping all your finances in a separate account means that you always know which is which when necessary.

“Comingling of funds can make it virtually impossible to separate business transactions from your personal life,” said Rhett Molitor, co-founder of Basis 365 Accounting. “That will raise red flags for anyone relying on your financials (e.g. IRS, bringing in a business partner, trying to sell the business).”

A separate account makes tax season easier. If, for any reason, your business needs to be audited, a separate account shows a clear record of your business’s income and expenses.

While opening and maintaining a separate bank account takes time, the “paper trail” offered by it can make managing your finances easier.

When you’re receiving invoices or paying contractors, it adds an aura of authenticity for them to be able to write checks to “YOUR BUSINESS” as opposed to your personal name.

With no separate bank account, your business may come across as amateurish, despite your best intentions.

Depending on how your small business is structured, you might face legal consequences if you do not have a separate bank account.

For example, many small business owners conducting business as a Limited Liability Corporation (LLC) do so to protect their personal assets. Under this structure, the owner won’t be liable for the business’s debts with their own personal assets. The business has a separate corporate identity.

Yet, if you do not have a separate bank account for your LLC, a court could potentially disregard the LLC’s separate identity because it’s so tightly commingled with that of the owner.

Consider how your business is structured when deciding whether or not to make a separate bank account.

So, you’ve decided to open a separate business bank account. What do you need and how do you do it?

For the smallest businesses, it might be easier to open a business account within the same bank as your personal accounts. However, be sure to conduct thorough research to determine which bank offers the best services for your needs.

Here are some of the documents you might need to open your business’s account:

Be sure to thoroughly research what documents the specific bank requires before trying to open your account.

While it may seem time consuming, opening a separate bank account for your small business is a worthwhile endeavor. It makes managing your finances easier, safer, and more legitimate.